The Chancellor recently released his budget with an aim to help consumers with the rising cost of living and the impact of inflation. How number 11 has decided to deal with the issues facing the UK is both unique and interesting (for some).

Rising Cost Of living UK

As we have outlined in previous updates – the current issues are supply driven which essentially means that rising costs can be pushed onto consumers by businesses. Rising raw materials prices and energy costs have a knock-on effect that ultimately hits consumers the hardest.

Companies with valued goods and services are able to increase their prices faster than costs rise which ultimately means that consumers are paying more for the same thing.

Rishi Sunak Spring Budget Changes

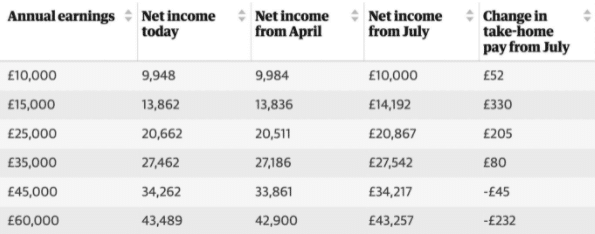

One of the biggest changes the Chancellor has made to help ease this pressure is increasing the National Insurance primary threshold from £9,880 to £12,570 to bring it in line with the personal tax allowance.

In conjunction with this – number 11 is still proceeding with the intended 1.25% rise in National Insurance contributions. This means that for everyone earning between £10,000 to £35,000 there is a net benefit in the threshold rising but anyone that earns above £35,000 will ultimately be worse off as a result of the new changes.

As detailed in the table below:

The rising cost of living hits lower earners the hardest and as such, the Chancellor is looking to target the budget towards helping them all the while increasing the tax take on higher earners.

In addition to this, the Chancellor is looking to reduce Basic Rate Income Tax from 20% to 19% in the same year (2024) as he is increasing corporation tax from 19% to a blend of 26.5% and 25%.

Once again, this increase is with a view to assist the consumer and to push more of the fiscal responsibility onto businesses.

Fuel Tax UK Changes

Finally, the most topical alteration for this point in time is the decrease in fuel tax by 5p (6p inclusive of VAT). This essentially means that consumers will see a reduction in cost at the pumps.

All in all, it has been a fairly balanced budget with the emphasis being shifted onto those who need it most.

If you would like to discuss how the changes impact your situation please feel free to get in touch with a member of our team and they will be more than happy to explain things further and assist with financial planning.

Related Articles

-

News

July 19, 2012

July 19, 2012Life cover costs likely to increase for women

Currently life insurance premiums for women are less than for men, as statistically, women tend to l.... -

News

A window of opportunity

Fixed premium policies that are already in place when the ruling comes in are unlikely to see a pric.... -

News

Slam Dunk! Acumen welcomes a new member to the team

After a lengthy search for the right candidate, Acumen is delighted to welcome on board Alex Dun....